Only well-to-do people are not good in their spending habits.

Whether one is rolling in money or not, if he is monetarily wise – he would use the wealth with good planning. Such people find ways and opportunities to invest and grow their already-earned money.

There are around 1.6 million millionaires in Canada as of 2021. The poverty rate of the States and Canada is 7.7% and 10.1% respectively.

There is so much one can learn from financially sensible people. Their approach toward finances is worth reflecting on.

Money Governance in Everyday Life

Scoring well in finance and math can’t teach you to be financially smart in life. It is certainly an art that should be induced from childhood so that a grown-up man can handle savings and spending sensibly.

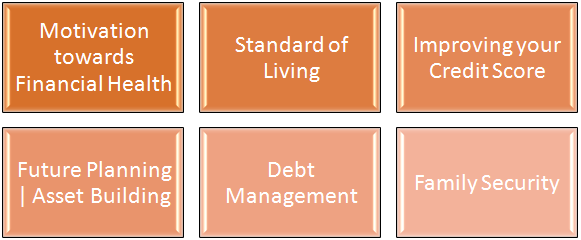

Motivation towards Financial Health

By keeping a track of your budgets, you are well aware of how much you earn, how much you save, and how much you need to earn to meet future needs finely.

You strive for better financial health by:

- Paying debts

- Timely bill payment

- Spending less than your monthly earnings

- Making and obeying a savings plan

- Maintaining emergency fund

Standard of Living

Whenever you scheme your finances, you are shielded from impulsive/ unplanned and unwanted buys. This saves you a good amount of money which can later be spent on carefully thought purchases and a better standard of living.

This rescued cash can also settle down emergencies (if any occur).

Improving your Credit Score

Good credit scores are significant for future lending agreements and credit applications. Credit bureaus keep a track of your past relationships with lenders to generate a score.

The higher the score, the better the loan terms and credit limits.

So, in order to show that you are a credit-worthy and trustworthy borrower – you must observe the repayment deadlines of secured credit card loans, bills, direct debits, unsecured credit card loans, etc.

Future Planning | Asset Building

Though assets come with liabilities like maintenance costs, they are proven to play the role of financial buffers in unfavorable situations.

People good with money pay close attention to the ways to utilize their finances so that they can afford to own an asset (obviously purchased after a good analysis of deals available).

- What am I earning right now?

- What would I be earning some years later?

- What are the monthly and yearly expenses?

- How much am I able to save monthly/ yearly?

Answers to these help to better speculate on future planning and family security.

Debt Management

A controlled amount of debt is not dangerous at all! However, spending more than you earn can push you into a vicious circle of debt pay-off and built-up interest rates.

Every 2/5 Canadian believes he won’t be able to get rid of debt all his life.

Having an unaffordable lifestyle can cause piled-up debt, rotten credit files, and stress. Thus, people good with money cautiously administer their debts.

A Financially Mindful Does Not Spend the Money on These Things

For someone to take benefits of money planning and financial management, he/ she must endeavor to reduce spending on the following:

Luxury Brands

Showing off branded items and luxury goods is not a habit of pocket-smart people.

Instead; they prefer spending on education, vacations, family life, investments, and business growth.

An average American makes 156 impulse buys each month.

Some people consider this unaffordable purchase as a reward to their sweat (while performing their job responsibilities). Others take it as a sense of accomplishment. But smart people know they don’t want brands to show off – they invest in personality and bank balance to flaunt.

Too Many Credit Cards

It is good to own credit cards as per your need. Some drawbacks of owning too many could be:

- Damaging credit score. Owning too many cards reduces your credit history which adversely impacts your credit score.

- Difficulty in managing multiple accounts

- More available credit might push you towards extravagant and unnecessary purchasing

- More annual fees

- Balance payments

Experian Credit Consumer Review research says: Each American owns 4 credit cards on

Quality over Quality

“Quality is the best business plan.” –John Lasseter

People good with money are not hesitant to purchase one good, long-lasting, and useful/ handy product instead of many, cheap/ substandard things.

E.g. if a software developer is smart with money, he won’t be shy to buy one good electronic (computer PC, laptop) instead of opting for a cheap option. He would take it as an investment.

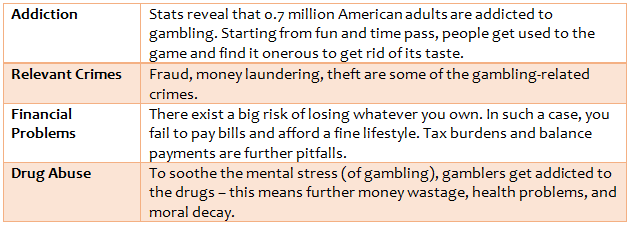

Gambling

Where physical interaction almost ended in the coronavirus era, the rise in the online gamble market got quite visible. Mentally rich people are totally in opposition to the idea of gambling.

The online gambling industry is expected to rise from $64 billion to $74 billion from 2020 to 2021 (12% compound annual growth rate).

1.6 billion people in the world gamble, while 1.2 billion gamble once a year.

People good with money understand the following drawbacks of the game:

Low-Cost Wedding

Wedding costs typically include:

- Transportation

- Dresses/ Attire

- Food

- Photography

- Goodies for guests

- Wedding Planner

- Venue Rent

- Décor

- Catering

Intimate, budget-friendly weddings are preferred by people good with money. They prefer to relocate the thus-saved money on other activities like couples traveling together or investing in a shared goal.

Plus a low-cost wedding means closer people only which is proportional to less stress and lesser anxiety.

Expensive Property

Rich families tend to spend more on properties than the majority. But still, they evaluate the available options to land on the best deal regarding location, home size, and of course the price.

The average cost of maintaining a luxury home is about $5k to $70k each month.

However, some other wealthy people don’t spend on homes at all. Expensive properties are proportional to high maintenance costs, and a decrease in savings/ investments.

Plastic Surgery

The trend of plastic surgery has its highs and lows. While some prefer it (also because they can afford it) others (mentally rich) have a body-positivity mindset.

More and more people are getting against the idea of body and beauty ideals.

“There is no weight limit on beauty.”

While plastic surgeries are expensive, people good with money think of spending money on education, and physical and mental health instead.

People Who Are Good With Money Obey These Habits

Whether you have earned wealth through digital marketing, acting, flying, swimming, tech, or teaching – to hold onto that wealth you gotta learn and practice smart spending habits for saving money for the future!

Money-smart people are always planning – they are future-oriented. They operate like companies strategizing ahead of time to mushroom their profits at a percentage higher than the previous profits.

This they do by envisioning themselves or hiring a team (of financial planners) to perform this job.

Some of the commonly found high-yielding habits of such people are as follows:

Saving and Investment are Their Routines

Money-smart people don’t rely on unexpected bonuses to inflate their savings. Their minds functioned to save a reasonable amount of money from their monthly income/ earnings.

7.6% is the average willing rate of Canadians to save from their monthly incomes (after the subtraction of living expenses and savings.)

7.6% values to CAD 410 monthly savings of an average Canadian.

Though there is no fixed percentage of saving to promise a good future – your monthly budget (and expenses) can help you plan this percentage.

You can also benefit from automated funds transfer (offered by some saving accounts) to automatically transmit a fixed amount every month.

Only 69% of adult Americans have approximately $1,000 in their savings accounts. (2021)

As far as investment is concerned, there are several stocks/ bonds one can make profits from. It is good to invest in multiple things instead of one stock to be shielded from big losses.

Also, market research and making trades/ investment is so easy with investment apps, in the present age, like Questrade, Wealthsimple, Questwealth, PocketSmith, etc.

A financially savvy would not () hesitate to hire financial planners, and investing experts for minimizing risks. They take this expense as an investment to swell their savings.

Avoid Overspending

Buying temptations isn’t always easy to stay away from. But this should also be as per the plan – no impulsive buys (we mean)!

A smart man stays away from what can cause him excessive credit card debt each month. This debt can lead you to:

- Dump in credit score

- Drop-in available credit limit – bringing in the stress if an unexpected emergency (like auto repair, health/ hospital expenses urgency, home maintenance) occurs.

- Balances on multiple cards: if one is habitual to spending beyond his means – he ends up with balances in multiple credit card accounts i.e. the accumulated debt.

- All of the above-stated disadvantages get even worse if you lose a job meanwhile or face a salary reduction in the future.

(2021) Each American family owes around $6,000 in credit card debt on average.

Approximately half a million Australians have $5,000 in credit card debt.

Continuous Learning – Read Books

Unsure, uncertainty, and losing are all part of the game.

But what can lead you ahead is constant learning/ market research/ reading/ educating yourself of the possible opportunities (like credit card rewards, discounted bonds/ stocks, a new app to invest in), the right way to grab them, maintain them, and discover better opportunities for future.

Reading books and articles, and being in the company of the financially driven bless this process.

Women who travel twice a year have lesser chances of stress/ depression than those who don’t.

Experience over things

Wise mindsets have faith that experiences (through traveling) bring up more joy and relaxation than the things purchased (with the present mindset).

Seeing new cultures, meeting new people, and building contacts help them take a break from routine work and family pressures. Plus, you are less prone to heart attacks! Not wasteful spending, right?

The chance to suffer a heart attack is decreased by 5% if you plan a vacation within 5 years.

v Financial Priorities

Financially mindful people understand that one is never able to work on goals unless one makes them first.

They know what their goals are, which they later arrange depending upon their importance in the person’s life.

Once the priorities are set, the most crucial ones are worked upon first and with more zeal.

This helps you in various ways:

- Manage money

- Retirement planning

- Risk management

- Tax planning

- Investment Mindset

- Cash flow management

Timely Bill Payment

When bills are paid on time, one saves himself from late fees and a credit score drop.

Technology today affords to save this hassle for you with automated bill payment systems. The order once granted to make automated payments saves you from worrying about timely bill pay-off each month.

One-quarter of Canadians face a hard time paying their bill on time every single month.

Keeping the Company of Pocket-Wise People

“The shortest way to get anywhere is to have good company.” – H. Jackson

Monetarily smart people have the ability to share this vibe of zeal and hard work in the environment around them.

Successful people, their financial habits, financial advice, and financial knowledge can improve and support you in countless ways.